Brighter Market Prospects for Palm Oil in 2023

Significant Drop in Palm Oil Import

The news of China’s gradual relaxation of its Covid-19 preventive measures since December 2022 was surely something that had been anticipated by many, especially by businesses which had been gearing up to visit China after their absence from the country for almost three years. Businesses have been affected since the Covid-19 pandemic outbreak in December 2019, wherein the zero-Covid policy of the country has from time to time pressed the stop button on social-economic activities in selected cities via lockdowns. In 2022, the lockdowns were the most rampant when many cities experienced sudden surges in Covid-19 cases. The oils & fats industry was not spared these restrictions, and was impacted by the regular lockdowns and the tightening of Covid-19 preventive measures.

China experienced its historical first drop in annual total oils & fats consumption in 2022, signifying the magnitude of Covid-19’s impact on the economy. According to Oil World, it is estimated that the oils & fats demand shrank by 5.5% to 39.49 million MT. Aside from the disruption to economic activities caused by the pandemic, the decline in demand was also due to the rising vegetable oil prices caused by geopolitical issues faced by major producers and exporters of oils & fats, including Ukraine, Russia, and Indonesia.

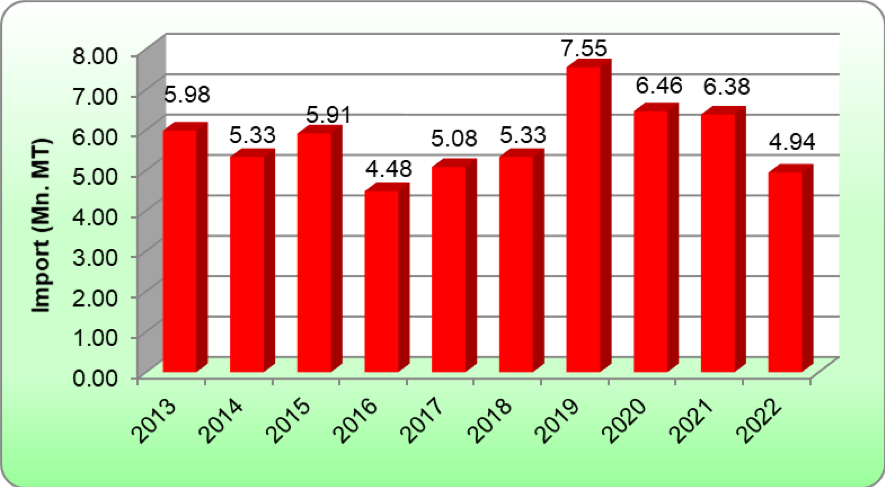

The import of palm oil into China recorded a significant drop in 2022, which is also the sharpest drop charted since China lifted the quantitative restriction (Tariff Rate Quota system) in 2006. The previous sharp drop in palm oil imports was witnessed in 2016 when total imports declined by 24.2%, or 1.43 million MT (Chart 1). Back then, the drop was mainly caused by the sharp increase in soybean oil production (by 14.5% or 1.83 mil MT), a drop in global palm oil output by 3.34 mil MT or 5.3%, as well as the high opening stock of palm oil at the beginning of the year.

The global palm oil output in 2022 was estimated to have increased by 2.68 million MT against 2021, while soybean oil output in China was expected to record a marginal drop of close to 300,000 MT. Despite this, China’s palm oil import this year has shrunk by 1.43 million MT, from the volume imported in the same period the previous year.

The significant drop in palm oil imports was due to the disruption in sunflower seed oil and rapeseed oil supplies from Ukraine and Russia, after the two countries engaged in a military conflict. Subsequently, the supply-demand imbalance of global oils & fats lifted most oils’ prices to their record high, and this has deterred the purchase interest of most importers, including the Chinese. At the same time, the export ban and restriction imposed on palm oil by the Indonesian government in 1H 2022 also halted the palm oil supplies from Indonesia, and further impacted the import pace of palm oil in China. This development has led to a sharp drop in palm oil imports in China by 62.8% y-o-y in the first half of 2022, but was later narrowed to 22.5% by the end of 2022. The pick-up in palm oil import in 2H2022 was attributed to the drop in crude palm oil (CPO) prices beginning in June, making palm oil and its derivatives more competitive against soybean oil (SBO) in China, encouraging the importers to import more especially when the stock level of palm oil in China has charted multiple-year low record by the end of June.

Chart 1 – Annual Palm Oil Import in China (mil. MT)

An analysis of the import volume by major palm fractions reveals that both RBD Palm Olein (PL) and RBD Palm Stearin (PS) recorded a significant decline, citing that the poor demand for palm oil was not only confined to food processing and catering sectors, which are major users of PL, but also in non-food sectors such as oleochemicals.

Table 1: Yearly Palm Product Imports by China (‘000 MT)

| Jan-Dec 2021 | Jan-Dec 2022 | Change (vol.) | Change (%) | 2020 | |

|---|---|---|---|---|---|

| RBD Palm Olein | 4,620.1 | 3,386.0 | -1,234.1 | -26.7% | 4,606.8 |

| RBD Palm Stearin | 1,725.3 | 1,537.3 | -188.0 | -10.9% | 1,805.5 |

| CPO | 0.1 | 2.1 | +2.0 | +2,000% | 15.7 |

| Others | 31.5 | 18.6 | -12.9 | -41.0% | 33.6 |

| Total | 6,377.1 | 4,943.9 | -1,433.2 | -22.5% | 6,461.5 |

Source: Chinese Customs

As highlighted in the previous article; “Change in Composition of Palm Oil Products Imported by China”, the majority of the shortening imported by China was used to substitute PL for food processing purposes, and it is estimated that approximately 600,000 MT of shortening was imported in 2022 for this purpose. Nevertheless, this was not enough to compensate for the decline in PL imports, hence proving that the demand for palm oil from the food sector was poorer by an estimated 620,000 MT in 2022.

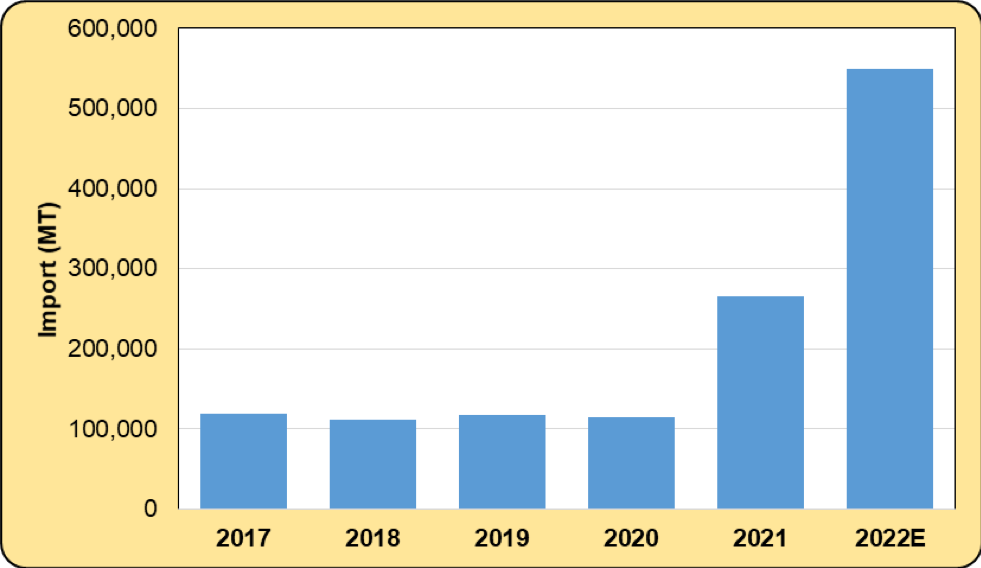

As for PS, it was reported that the import dropped by 10.9% or 188,000 MT as compared to the previous year. However, if we take into account the import of hydrogenated vegetable oils in China in 2022, we would find that the import of oleochemical feedstock didn’t drop by much.

According to Chinese Customs, the import of hydrogenated vegetable oils skyrocketed in 2021, and the growth remains significant in 2022. In 2021, the import of hydrogenated vegetable oil was more than double that the previous year (264,900 MT vs. 114,900 MT), while the import of this product in 2022 jumped by an estimated 285,000 MT against the 264,900 MT recorded in 2021.

The jump in both shortening and hydrogenated vegetable oil in China is closely related to the change in Indonesia palm products’ export duty structure in 2021, which favours the export of downstream palm products through very competitive prices, and this includes shortening and hydrogenated palm stearin (HPS). At the same time, the import of HPS by China is exempted from import duty under the ASEAN-China FTA (ACFTA), as compared to the 2% imposed on PS (shortening has been enjoying 0% import duty under ACFTA since 2006). Subsequently, some importers in China switched partially from importing PL and PS to shortening and HPS, to enable the local food manufacturers and fatty acid producers to lower the cost of production and compete with the imported vegetable oils and fatty acids. Hence, it can be deduced that the HPS imported by China in 2022 amounted to 430,000 MT, an increase by 280,000 MT from 2021.

Chart 2 – Import of Hydrogenated Vegetable Oils in China (MT)

Positive Outlook of Palm Oil Demand in 2023

After what has been considered the worst year for Chinese oils & fats players, the lifting of Covid-19 preventive measures, which encompasses the easing of border control as well as many other pro-business policies, is surely going to boost the economic activities and the demand for oils & fats in China in 2023.

According to IMF, it is forecasted that the GDP of China will grow by 5.0% this year. Although it is lower than the five-year average of 5.3% charted in the 2018-2022 period, the cheaper current vegetable oil prices against those of 2022, as well as the various government economy incentives are expected to boost demand by 1.2 to 1.5 million MT. This is based on the growth witnessed in 2021 when the zero-Covid policy was able to keep the number of Covid-19 cases very low, where economic activities around the country recovered in the same year. The year saw the demand for oils & fats increase by around 1 million MT when GDP rebounded by 8.1% in 2021. Hence, with a similar or even more encouraging situation this year, the demand for oils & fats is expected to post a stronger growth as compared to in 2021. In the February 2023 issue of the “Monthly Report on Supply and Demand of Oil and Fat Market” released by the National Grains and Oils Information Centre of China (NGOIC), the government think-tank projects an increase in edible vegetable oil demand in 2022/23 by 1.42 million MT.

Nevertheless, the demand will not surpass 2021’s volume (41.77 million MT) due to several reasons. One of them is the population factor.

Slowdown or Negative Population Dampen Oils & Fats Demand Growth

Last year, China recorded its first decline (by 850,000) in population growth in the past 61 years, and some experts are of the view that the population number might not grow or fluctuate at the current level in the next few years and subsequently drop further thereafter. The population is an important factor in contributing to the higher demand for goods, including oils & fats, with the population registering its first drop in 2022 and is expected to stay stagnant in the next few years, and this will inevitably affect the demand for oils & fats from the consumers, limiting the growth of oils & fats demand in the country.

Competitive Price Lifts Palm Oil Demand

Nevertheless, with a better outlook of oils & fats demands in China, demand for palm oil certainly will also rebound from the 5.39 million MT (PO and HPS) recorded in 2022. With Oil World forecasting the output of CPO to increase by 3.22 million MT in 2022/23, it will make available more palm oil for export from the two major producers in 2023. With the current price discount of PL against SBO (>RMB1,500 or USD220/MT) in China, PL will remain attractive to substitute SBO in various food processing applications. This will be also boosted by the prospect that the catering sector will recover from the slump experienced in 2022, and at least boost the demand for oils & fats by an additional 20%, with the sector’s annual revenue matching pre-Covid levels (2019).

Continuous Slowdown in Soybean Oil Output Provides Room for Palm Oil

Besides the various positive signs that will lift the demand for PO in China, the policy of substitution and replacement of soybean meal in animal feed has also slowly seen its impact on soybean crushing activities. According to the statement released by the Ministry of Agriculture and Rural Affairs and NGOIC, it is forecasted that the soybean crushing volume will only increase by 4.0 million MT. This will translate into an additional 720,000 MT SBO being produced in 2022/23. However, with the supplies of sunflower seed oil (SFO) remaining tight this year, rapeseed oil and SBO will fill in the gap left by the low import of SFO in the Chinese market, and this will give more room for the demand of palm oil in China.

Demand from Oleochemical Sectors Will Support the Stable Demand for Palm Oil

From the oleochemicals sector perspective, with the recent announcement by the Chinese government on the relaxation of Covid-19 preventive measures nationally, economic activities are expected to recover progressively and significantly in 2023 against 2022. Furthermore, the support given by China in the property market also serves as another booster to drive the demand for major oleochemicals such as stearic acid, glycerine, and fatty alcohol. This will inevitably support the higher need for feedstock such as PS and HPS to satisfy the production needs of these oleochemicals in China. Hence, we shall see higher overall output and import for oleochemicals, and also import for PS and HPS, which will in turn support the overall growth of palm oil consumption in China in 2023.

Uncertainty in Indonesian Palm Oil-Related Policies May Benefit Malaysian Players

With the positive outlook that lies ahead, palm oil demand and import in China are poised to inevitably increase in 2023. However, the situation from the supplies would also play an imminent role in determining whether palm oil players are able to capitalise on the opportunities offered. One of the factors that may affect the overall import of palm oil in China would be the uncertainties in the current Indonesian palm oil export policies. For instance, as highlighted at the beginning, the drop in the import of palm oil in 2022 was partly caused by the export ban imposed by the Indonesian government, and this export restriction issue has been haunting the exporters again since early this year, with revised DMO (Domestic Market Obligation), suspension of some export quotas, and many other impediments. Hence, should the condition last for several months such as what happened last year, this will surely affect the export of Indonesian palm oil to China. But on the bright side, such a policy would benefit the Malaysian palm oil players, by allowing them to fill in the supply-demand gap left by its neighbour. This is also supported by the fact that more foreign labour has been slowly brought in to work on Malaysian plantations, which is set to boost the CPO output of Malaysia and allow the Malaysian palm oil industry to capitalise on the opportunities that have emerged.

Prepared by Desmond Ng

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.